Credit Unions have a history of uncomplicated products, simplified procedures, and a generous community spirit, which is why the sector enjoys a level of consumer trust and loyalty that the bigger lenders can only dream about.

However, it’s important not to become complacent. Supporting your community by merely existing within it doesn’t offer the support many need in a time when 1 million Irish people are living in deprivation. Reaching out and becoming more involved with your community means those in financial difficulty become aware of your brand and the help you can offer them, potentially allowing them to turn their back on exploitative lenders. But how can you do this effectively, in a way that still promotes your products and services?

Engage with younger members of the community to find out what they need

Targeting the younger people in your community is essential to the future viability of your Credit Union, but can often feel like an impossible task as they flock towards challenger banks like Monzo and Revolut.

These new providers offer innovative services, but more importantly these services are developed through continual customer feedback - young people use them because they can feel involved and like their specific needs are being answered. So why not ensure your Credit Union is doing the same?

Invest in community schemes and projects

Small community schemes are often vital to those who use them, but chronically underfunded. Many Credit Unions already invest in local children's gaelic and football teams, but reaching out to groups that help adults can be an easy way to get new (and existing, unengaged) members through the door.

A good example is offering debt advice services in a community centre, rather than solely in your Credit Union. Why not reach out to your local Citizens Information and work collaboratively?

Help local businesses

In order to apply for a business loan, many Credit Unions require applicants to undergo full risk assessments - something that not only protects your Credit Union, but benefits the business owner. Larger loans often require a business plan and financial projections.

Many small businesses may not have these documents in the detail they truly need to understand their future, so why not offer help in preparing and planning their strategy, with the end goal of encouraging the business to take out a loan?

Hold free advice days where people can get to know the Credit Union easily

Holding an evening event where members and non-members alike can call in, ask questions and get free advice is an excellent way to increase your brand presence in the community while honouring the core Credit Union ethos.

Giving people the advice they need around finance - be it increasing their credit rating or how to take out a first time buyers mortgage - builds trust in your brand, your advisors, and your Credit Union, which in the longer term means a surge in uptake of new services - especially if you incentivise members to refer a friend who’s not already a member of the Credit Union.

Reach out to your older members

In the quest for new, young members to create a viable future, it’s important that you don’t forget about the members who’ve supported your Credit Union for years - possibly since year one!

Older members of the community can often feel isolated - especially as technology becomes a centerpiece of society. Outreach programmes like Barclays Digital Eagles that keep older members involved by teaching them how to use your online and digital offerings are a great way to ensure your core membership stays up to date with everything you’re offering.

Stuck for ideas? Don't be afraid to reach out to other Credit Unions for advice!

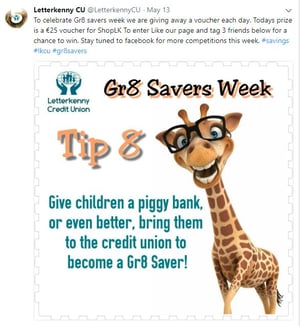

Schemes like Letterkenny Credit Union’s Gr8 Savers offer a combination of savings tips alongside voucher competitions, giving their junior members the chance to win prizes as well as teaching children the value of money and how to save, knowledge that will serve them well into adulthood.

Credit Unions are usually well known in their communities, staffed by volunteers and people who want to help improve their local area through offering affordable loans and financial advice. Extending that ethos beyond your front door is a rewarding way to connect with the community and promote your products and services

Want to find out more about how you can grow, manage, and protect your way to success?