Last week saw us kick off our second cuEngage of this year.

cuEngage is an industry event which focuses on the Credit Union market and a chance for attendees to network and share best practices. We typically host cuEngage as a physical event (see short video here) but due to the pandemic, we’ve taken it online this year.

This time, we organised 4 separate online sessions, each with a different focus but all with the same key theme: Digital Transformation. This has always been an important aspect for Credit Unions, particularly now.

The 4 sessions covered:

- The Digital Member Journey

- cuMobile; new mobile app

- Decision as a Service

- 2021 Product Roadmap

The Digital Member Journey (watch the full session here)

Your member’s digital journey has always been an important focus for your Credit Union. But the pandemic has further catapulted this urgent need to serve your members across multiple channels.

The session started by outlining two very different member personas, both utilising very different channels, but ultimately wanting the same outcome from their local Credit Union.

View full poster here.

We then heard from 4 Credit Unions on their tips and best practices around online services and marketing themselves to their members. We’d like to thank again 1st Alliance, Core, Croi Laighean and Member First Credit Unions for leading this super informative session. Below are the key takeaways from this session, and you can read in more detail these takeaways in our blog ‘The Digital Member Journey’

Key findings from this event:

- It’s vital to have a digital strategy in place to react so quickly. If you don’t have a digital strategy, you need to build one.

- Online banking and the ability to join the Credit Union and apply for/receive loans online proved to be successful during a time where loans were decreasing.

- Marketing these digital services is everything. And build your marketing strategy around data. You could have every digital service available but if you are not marketing these to your members, there will be no adoption.

- Never under-estimate the power that some simple process changes can have. SMS PINs and e-signatures are small changes with huge results.

- Even during this difficult time, Credit Unions were so quick to react and are still delivering that excellent member experience. Not only by providing them with more choice and flexibility, but by injecting hope and happiness back into the community.

cuMobile (request full session here)

The following day was the introduction of cuMobile, our brand new mobile app. Our development team outlined the process of developing cuMobile from start to finish, including customer input, testing and early access trials.

We then heard from Dundalk Credit Union and HSSCU around how cuMobile is a key element of their digital strategies. You can read about this in more detail in our blog, but below is a high-level overview of why cuMobile is so important to them.

Key findings from this event:

- Credit Unions are dealing with an aging demographic and cuMobile helps them reach that younger audience

- Members want to self-serve and do more themselves, without having to speak to Credit Union staff or pop in branch. Some even find having to go into branch as a barrier.

- Members now more than ever are used to managing their lives digitally, whether that’s working from home, connecting via social media and managing their finances.

- Credit Unions need to generate efficiencies, and cuMobile provides many efficiencies including biometric login reducing the need for OTPs and push notifications allowing for instantaneous information sharing.

- Having the Credit Union’s brand across all the app stores boosts brand awareness and reputability, completely inline with their digital strategies.

You can learn more about cuMobile and request a demo at www.well-it.com/cumobile

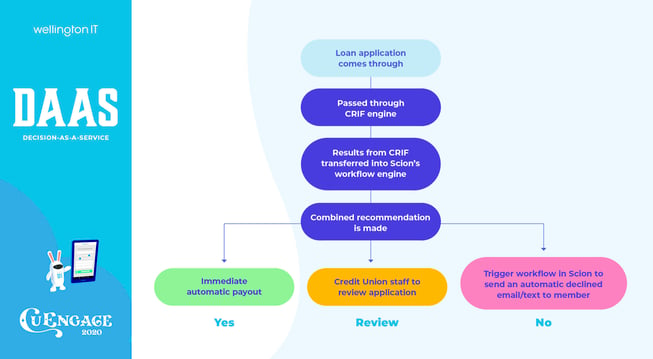

Decision as a Service (watch full session here)

Michael Byrne from Core Credit Union kicked off a session on the importance of Decision as a Service as part of the loans process. Michael was the person who introduced Wellington IT and CRIF, who immediately started collaborating together to enhance the loans process for both Credit Unions and their members.

During the session, Ian Glenn, CTO at Wellington IT explained Core’s current loans process, alongside their next phase which will be integrated with the CRIF gateway. Some of the manual processes will be taken over by CRIF, saving Core Credit Union time and money.

Giovanni Catinari from CRIF outlined the 4 key pillars for a data-driven decision support tool which covered smart data connectivity, credit scoring, affordability analysis and ultimately the decision engine.

Ian then concluded the session with the future view of DaaS and how it will further transform your digital loan offerings and benefit your Credit Union and members.

The next step from Wellington IT and CRIF is further workflow enhancements to Scion which will allow your members to apply for a loan and automatically get a decision based on a multitude of factors made available by CRIF, such as recommended decision and credit scores.

Michael also highlighted the benefits of DaaS which included the fact that DaaS works 24 hours a day, 7 days a week, 365 days a year, and the information brought about from CRIF is accurate and reliable.

If you are interested in learning more about DaaS, please complete this form.

2021 Product Roadmap (watch full session here)

We ended the week with an interactive session around our 2021 Product Roadmap. We simply cannot develop our roadmap without the input of our customers so we sent you a survey beforehand asking things like your top opportunities, challenges and offerings that you see for 2021.

There was great engagement during the session also, with some great ideas to help develop the 2021 Roadmap further.

The key findings from this event were:

- 80% of Credit Unions surveyed had a digital strategy, most of whom reported it as having being escalated since Covid. The importance of a digital strategy is paramount, as highlighted by 4 Credit Unions in our other cuEngage session on the Digital Member Journey.

- Loan book growth was the most important area of product development for Credit Unions surveyed. We can see from recent data points that loan book growth has dropped making it even more important than ever.

- Biggest challenges will be the aftermath of Covid, with things like recession, decline in loans, and decline in membership

- Biggest opportunities include business lending, insurance and current accounts – providing their members that one stop service for all their financial needs

- The things they were looking forward to offering their members are Revolving Credit, Current Accounts and business products such as lending and insurance.

If you didn’t make our 2021 Roadmap discussion, don’t worry! This is a continuous project and we’ll be in touch with all our customers again to discuss your needs for 2021.