Current news.

In January, Minister for Finance, Paschal Donohoe announced he is looking to amend legislation to increase the interest rate cap for Credit Unions, after recommendations from the CUAC Report Implementation Group.

He has asked officials to start preparing legislative changes needed to allow Credit Unions to charge higher interest rates on loans and financial products. If this is approved, monthly caps on interest rates would rise from 1% to 2%. Flexibility will also be introduced to allow the interest rates to be amended in the future by the government following consultation with the Central Bank and the Credit Union sector.

Heavy administrative burden.

This increased interest also means that it's more worthwhile for Credit Unions to offer smaller loans. It's reported that Credit Unions are struggling to roll out a scheme to compete with these moneylenders because the State-designed scheme is loss-making and bureaucratic for them.

Only half of Credit Unions offer the 'It Makes Sense Loans' targeted at those on social welfare payments.

Ed Farrell of the Irish League of Credit Unions said the typical 'It Makes Sense loan' was small, at around €500. He said there is a heavy administrative burden on credit unions issuing these smaller loans. This increased cap could help with this.

Whether you choose to adopt this legislation or not, there are other ways to gain a better RoI on your loans.

Allow members to self-serve.

This may sound like it’s going against the grain of Credit Union, and it means less face-to-face customer service. But this doesn’t equate to poorer customer service. Studies such as one commissioned by Zendesk, show that 67% of people prefer self-service over speaking to a company representative.

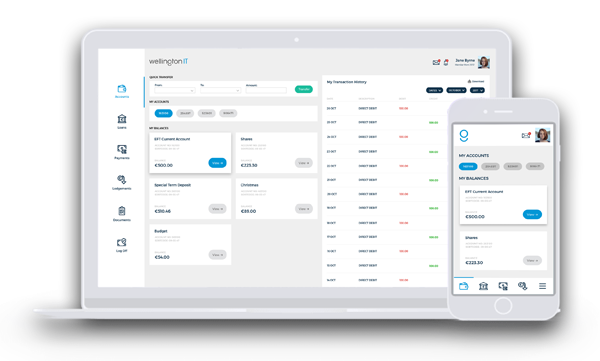

And according to a Visa Digital Payment Study, 78% of Irish people now use their mobile devices to keep track of their finances.

Providing tools where people can sign up to a Credit Union, manage their finances, and even apply for loans, at any time, from anywhere, will massively reduce your administrative burden. You will save time in onboarding new members, and you can use this time processing more loans, faster and more efficiently.

How real Credit Unions are using IT to boost their membership and loan book.

Member First Credit Union provide digital tools to market to Millennials, and they have seen a growth in loan book of 25%.

“In 2017 Member First issued about 18,000 loans. There are three to four documents per loan, per member that would need to be signed and scanned to the member’s account. That can take up to 20 minutes in the office. If a member was to do that online, it would take them about 5 minutes”, Niamh Warren, Senior Member Services Officer at Member First Union.

Member First’s tools allow members to e-sign documents as well, so there’s no need for members to physically visit a Credit Union at the application stage of the loan process.

Automated credit checking systems such as CRIF can drastically reduce the amount of time and effort it takes to perform a credit check. The projected time savings of electronic credit checks for an average sized Credit Union is almost 700 hours per year*.

Digital tools.

Allowing members to manage their finances online, and tools such as digital member onboarding and e-signatures are proven to give your Credit Union back more time. More time to spend with those members who still choose to visit your branch, more time to grow loan books, and more time to serve your community.

*based on typical annual loan volume of 5500 and a manual process taking approximately 5-10 minutes.