Self-service technology enables Credit Unions to strike the balance between personal contact and a more efficient service.

With numerous steps for many standard transactions in your Credit Union, why not cut processing time by empowering your members to do more?

New start-up banks such as Revolut, Monzo and N26 disrupted the financial market by offering a fully digital experience to their customers. Whilst these new institutions are particularly popular with millennials, the success of these digital natives isn’t based solely on them being exclusively apps. Almost all challenger banks focus on a mixture of corporate social responsibility and making their users feel like they part-own the bank. Sound familiar?

From Virgin’s tree planting initiative for customers paying their bills, to Monzo’s initiative to getting customers involved as investors, modern banks are striving to create the ethos you’ve always had!

However, a study by cuToday 2018 states that “50% of consumers feel branch banking is important, and more than four in ten millennials find branches essential for their banking”.

But technology is also important...

It’s refreshing to hear that consumers still believe in branch banking. After all, people do business with people because they choose to - not because they have to. People can always find others selling the same thing, or providing the same service, but it’s the personal connection that makes the difference.

However, technology in branch is also important to consumers as it provides convenience, efficiency, and a better overall member experience.

So why not save time by allowing your members to do more of those steps themselves.

Credit Unions can take advantage of self-service tech to bridge the gap between a digital and physical service by offering in-branch self-service technology, such as:

Digital signing at the counter

This technology not only helps speed up counter transactions, but automatically stores the digitally signed document in your core system, removing the need to print, sign and scan the paper copies.

How many pages do you print, sign, and scan a day? How much time would you save if your members could sign on the dotted line digitally at the counter?

ATMs and deposit-taking kiosks

These help reduce queues in Credit Unions by allowing members to self-serve. These positive interactions allow staff to give more time and effort to promoting services such as loans. Members who simply want to withdraw cash can do so conveniently avoiding the queues, and still leave with a smile on their face.

Cara Credit Union are currently saving up to 45 hours per week with kiosks. In 2017 alone, they saved €36,600 by allowing their members to use a self-service kiosk for lodgements and withdrawals.

Whilst in-branch, self-serve technology is important, you need to also ensure that you have improved online processes as well.

Loan submissions, processing and approvals done electronically, save time for both members and the Credit Union

Credit Unions are currently undergoing big changes to how they lend, including the addition of the Central Credit Register (CCR) to the existing Irish Credit Bureau (ICB), which gives them greater visibility of an applicant’s financial history. With this, risky lending becomes less of an issue, and Credit Unions can focus on getting more good quality loans through their books.

3rd party technology company CRIF are currently working with Wellington IT to create a multi-bureau solution that, combined with pooled data and improved analytics functionality, will eventually give Credit Unions a single view of their member’s history, creating an automated credit score following any application.

The projected time savings of electronic credit checks for an average sized Credit Union is almost 700 hours* per year.

*based on a typical annual loan volume of 5500 and a manual process taking approx 5-10 minutes.

The ability to apply for loans online combined with this automated decision engine means that Credit Unions will only need manual intervention at the final stage of the process - saving them almost 700 hours per year! Faster approvals opens up a future where you can complete more loans, with less risk, in the same amount of time.

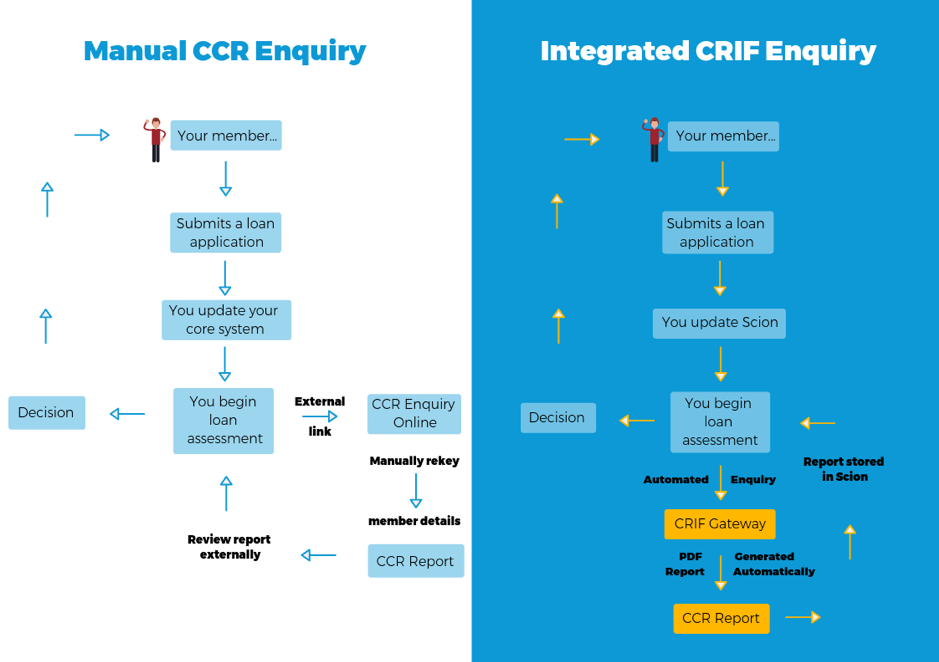

*CCR enquiry comparison is based a manual CCR enquiry comparing against the integrated CRIF enquiry for Wellington IT customers.

As you can see from the diagram, a manual CCR enquiry requires the member of staff to access an external link completely outside of the core system meaning all of the member’s details need to be rekeyed.

The integration with CRIF means that the entire CCR interaction occurs solely within your core system and requires minimal manual intervention.

Final thoughts

Since studies show that half of people still find branch banking important, Credit Unions should aim to provide a holistic experience for their members. Kiosks, ATMs, Digital Signatures - they all give members a choice on how they’d like to transact with you.

And by streamlining your core processes through this technology, your staff will save time re-entering information, and printing, scanning and storing documents. This time can be used to strategically plan how to grow your members and revenue.

To learn more about some of the self-service technology available to you, download our free eBook ‘The Future of FinTech in Irish Credit Unions’.