When it comes down to it, Credit Union members are people and everyone is unique. Whilst one member may not have the time to make the trip to their local branch, another may not want to manage their finances completely online.

At Wellington IT, the technology that we provide our Credit Unions ensures that each member’s journey is respected and personalised, whilst still improving Credit Union efficiencies along the way.

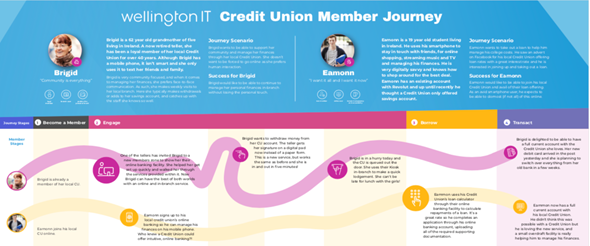

View full graphic here.

The graphic above demonstrates how we do this by using 2 typical member personas as an example. Each journey from sign-up to borrowing, right through to making regular transactions has options to suit the member.

Take Eammon. Eammon can sign up to his local Credit Union online by uploading his supporting documents and signing documentation electronically. He can also apply for a loan straight away, by completing the online loan application and e-signing any documents. Now he can manage all his finances completely online with intuitive online banking!

Equally, what if Brigid wants to come in branch to lodge money into her account and have a quick catch up with her ex-colleagues? She can still lodge money at the counter, and for those days when she is in a rush, she can lodge her money via the self-serve kiosk if the Credit Union is busy.

The key to all of these services is to offer flexibility and choice with minimal disruption to the member and staff. Asking Brigid to digitally sign a withdrawal form means the staff member no longer has to rekey or scan a paper form - this is automatically uploaded to the system and Brigid is in and out in 5 minutes! It also drastically reduces any human error associated with the rekeying of information.

Technology is always evolving. We at Wellington are your local provider with the agility to meet these constant changes. However, one thing still remains: technology must be built to benefit both the members and the Credit Union. For example, with our online loans application process, allowing Eamonn to upload his supporting documents means that not only is it more convenient for him, there is also minimal document handling for the Credit Union, plus the decision on the loan is much quicker to process!

As you can see from the member journey graphic our focus with our 2020 roadmap is to continue to strengthen these services. Decision-as-a-Service will not only speed up applications, it will also facilitate smarter lending. Revolving Credit will provide a new type of loan to offer to members. Open Banking will be a huge opportunity for your Credit Union to own the personal relationship with your members.

The future for Credit Unions is exciting and we are so pleased to be on this journey alongside our customers.

While you're here, check out our blog on how to save time with self-service technology!