On Wednesday 21st October, over 150 people from the UK and Ireland were in attendance at Wellington ITs cuEngage event, as David McWilliams spoke about the impact of Covid-19 and Brexit, on Credit Unions. Before that though, David shared how delighted he was to lead this session for Credit Unions.

“No one really understands the extent to which credit is actually part of the transformation of this country. Credit and access to credit is as important as access to education and access to housing”. David McWilliams

We can all agree this year has been one filled with challenges and uncertainties. Loan books decreased by an average of 40% in Q2 compared to Q2 2019. But it also brought great opportunities e.g. There’s been a 100% uplift in demand for digital services in March vs the highest month in 2019, and this trend doesn’t look likely to change as the monthly average in 2020 is 72% higher than in 2019.

Of course, it's not just Covid-19 that is affecting both the UK and Irish economy, we have the impacts of BREXIT coming into effect soon too!

Executive Summary

- “No one really understands the extent to which credit is actually part of the transformation of this country. Credit and access to credit is as important as access to education and access to housing”. David McWilliams

- There’s been a 100% uplift in demand for digital services in March vs the highest month in 2019, and this trend doesn’t look likely to change as the monthly average in 2020 is 72% higher than in 2019.

- In the case of Covid, the pandemic and the economy are actually moving against each other. Only once people start talking, can we become confident again; we start taking more little risks. Only then will the economy improve.

- SMEs contribute 62% of all earnings in Ireland. 55% of all income tax, 55% of USC, 58% PSRI, 63% of all VAT.

- Capitalism will be saved by social capital. The only way for companies to thrive is to begin to see themselves as part of the organic infrastructure of the community, that they can give back and treat people well. And have members, not users.

- “I would like to thank you, really thank you, for the unheralded role that you’ve had in the profound transformation of this country. I speak not only as an economist or a friend, but as a fan, who is in awe of the role of local community banks, helping local community people, who in another world, would not have access to credit”. David McWilliams

- Credit Unions already have the social value. You’ve also already got the technology in place. You need to utilise BOTH of these to keep going and keep the conversation moving to get through this pandemic.

The impact of Covid on the economy

In terms of the impact of Covid and Brexit, David offered some sound advice.

In a crisis, you’ve got to do 3 things;

- Define your reality;

- Define your reality, not as you’d like it to be, but as it is;

- Don’t talk about it; DO something about it!

David spoke very passionately about how we as people, social beings at heart, actually talk our way out of a recession.

How the economy, at its core, is unbelievably social. ‘We, as people, are at the heart of the economy, and it’s up to us to fix it’.

In the case of the pandemic, this is a lot different. The pandemic is preventing us from being social and talking, with social distancing and lockdowns in place. In the case of Covid, the pandemic and the economy are actually moving against each other.

People aren't meeting up and talking anymore. No more chatting to your neighbour and finding out they're putting an extension on their house. No more catching up with your co-workers at the coffee machine and learning they're trying out the newest restaurant in town. No more inspiring people to go out and try new things.

It's when people talk, they inadvertently promote spending money.

Only once people start talking, can we become confident again; we start taking more little risks. Only then will the economy improve.

A massive opportunity for Credit Unions

Credit Unions, with social value at your very core, are one of the key organisations that can help rebuild our economy.

Deemed an essential service throughout the pandemic, Credit Unions are in constant contact with their members, be that in-branch, over the phone or, more popular now than ever, online.

You only have to be on social media for 5 minutes and you’ll see some great feedback and press regarding Credit Unions. AND you’ve won the best Customer Experience 6 years in a row! A world record!

You’ve worked really hard to put all safety procedures in place in-branch, for those members who still wish to visit during the pandemic. Self-serve kiosks have also proven invaluable in some Credit Unions in the country. For example, Letterkenny Credit Union have seen a 170% increase in kiosk usage during the pandemic! (read more here).

But you’ve accelerated your digital strategy in order to maintain services and communication to your members who prefer to stay at home during the pandemic. And to meet the demand of these members. You’ve offered things like loan repayment breaks, cocoon services, PINs via SMS and allowing members to withdraw savings online, to name only a few! (Read our blog on how Credit Unions have thrived during the pandemic here).

You’ve continued giving back to the community and charity via raffles, draws and competitions.

You are keeping the discussion going – bringing people together thus continuing the conversation amongst us all.

How to attract more borrowers?

This question was pitched to David, and here’s a summary of his answer.

You’d think with low to no interest rates, more people would borrow.

We’ve been brought up in an interest rate environment which has always been significantly positive; 5%, 6%, 7%.

You’d think with interest rates of 0%, people would be spending and borrowing in their masses, but they’re not.

Why? Because they’re caught in a liquidity trap. They’re too worried about the future to take out loans, despite the interest rate being 0%, 1% or 2%.

So as Credit Unions, if you’re sitting on a pile of cash now, you should be aggressive in trying to get that money out in the market, by encouraging people to borrow. But who’s going to borrow? Probably not middle-aged people, but the younger people.

This probably isn’t a “eureka moment” for many of you, however Business Intelligence Tool, cuInsight, can provide you with a wealth of data of the behaviours and demographics of members who have borrowed in the past. For example, those who are regular borrowers, who have never borrowed, and much more, and allow you to segment and target your marketing efforts accordingly.

Key takeaways from cuEngage in relation to borrowers:

- SMEs contribute 62% of all earnings in Ireland. 55% of all income tax, 55% of USC, 58% PSRI, 63% of all VAT.

- 74% of all employment is in the productive sector (non civil service sector). Half of Irish people are employed in SMEs that employ less than 50 people.

- There are more immigrants now in Ireland than there are unionists. 1 in 6 Irish people is an immigrant and its changing very quickly. This is a huge untapped market.

- The sectors in the population who aren’t banked, want to be part of the locality, and be a part of their community. They want to join a club and a Credit Union is like a club.

- Teens like Revolut because the app is fun. The app feels like a game to them. In their heads they’re not even transferring money, they’re involved in something else. It’s not because that generation don’t want to bank, they do! They’re drawn to these challenger banks because they’re brought up on Xbox: experiences have to feel like that to them, particularly anything digital; it needs to feel “gamified”.

- Technologically, you can do all this stuff. How do you make it fascinating? How to make them drop their snapchat and do something else? It’s all for the taking. It’s the proposition.

- Younger people hate dislike the big banks. They ‘get’ the concept of social value, the idea of community, that there’s a greater calling than just profit. If you’re a member of a Credit Union it’s kinda cool, a lot cooler than being a part of a large corporate bank. You’ve got to make that distinction in their head that the Credit Union is something to brag about.

The importance of social value

With increased competition from larger banks and FinTechs who are more switched on to CSR it is becoming harder for Credit Unions to distinguish themselves in the market and articulate their true value.

According to David, the concept of Social Value is huge. At the moment, there is a paradigm shift in actual capitalism and economic.

Capitalism will be saved by social capital. The only way for companies to thrive is to begin to see themselves as part of the organic infrastructure of the community, that they can give back and treat people well. And have members, not users.

This is something Credit Unions are renowned for, and Credit Unions need to maximise their stories.

The small loans that don’t necessarily make the front pages of the newspapers, all those small loans make more of a difference than the large loans given to developers and industrialists.

Credit Unions are what helped your Granny and Granda buy their first house. They’re what helped Uncle Mick set up his own business. And they’re what helped your best friend renovate their home for the arrival of their new baby.

These are the stories that make the difference. Please be sure to share these stories far and wide.

How to continue to compete with other FinTechs and Challenger banks in the future?

When it comes to competing against the other FinTechs and Challenger banks, you already have many of the tools in place to do this.

We at Wellington IT have helped enable Credit Unions to facilitate this demand with digital tools such as cuMobile, e-signatures, ID Verification and Digital Member Onboarding.

This acceleration of your digital strategy is also helping to attract new members (and younger members) to join your Credit Union.

St Dominic Credit Union, for example, have seen that 65% of members who have opened a current account with them are under the age of 40 – a key demographic (read case study here).

We launched cuMobile in July of this year, the first full-service Credit Union app in the market (some press coverage here). So far we have over 20 Credit Unions gone live with cuMobile to their members, over 22,000 downloads and 5* reviews.

Prospective members can join their Credit Union via cuMobile and have their ID automatically verified with a liveness test.

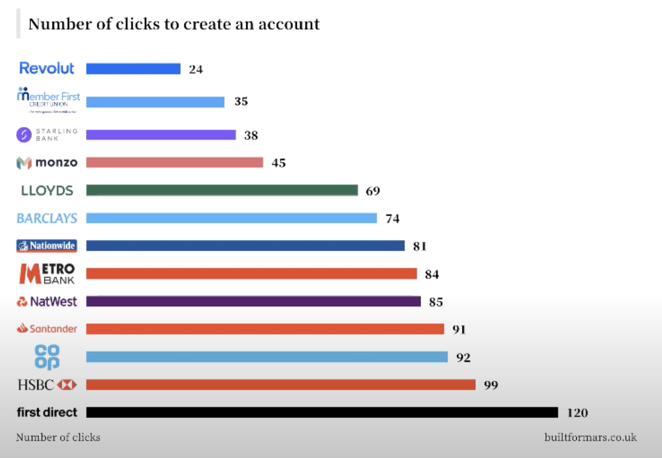

Independent research by Member First Credit Union and builtformars shows that members can have an active account with their local Credit Union in as little as 35 clicks, second only to Revolut.

Not only this, but with cuMobile, your members can join your Credit Union, apply for a loan and receive that loan, all in the very same day, thanks to online application forms including ECCU and e-Signatures. A service that banks can’t even offer yet!

We’ve engaged with our customers these past 6 months from surveys and Special Interest Groups to gather your ideas and feedback on what you – Credit Unions – want to see in our 2021 Product Roadmap.

Exciting projects that are available now or are available soon include;

- Revolving Credit – offer your members more flexibility and choice with a Revolving Credit loan (read more here)

- Decision-as-a-Service – provide an even better online lending experience to your members with recommended decisions, meaning successful members can receive their loans even quicker.

- Private Cloud hosting – host Scion in our private cloud which results in faster performance, enhanced security and reduced costs for your Credit Union.

- Online budget accounts – provide your members with the ability to create, manage and maintain a budget, allowing them to be in control of their money.

- Mortgage module – significant enhancements to the existing mortgage capabilities to enable fixed/variable rates with fixed terms and automatic rate switching.

- Non-member loan applications – Ability to provide an easy mechanism for non-members to apply for a loan and whilst they do this, capture the details needed to onboard them as a member should their application be successful.

These initiatives above are only some of what we currently have in development and what we have planned for 2021.

We are much more than your software provider – we are your strategic partner, and we want to be with you every step of the way in your success.

In conclusion

Credit Unions already have the social value, (you’ve written the book about social value!)

You’ve also already got the technology in place.

Utilising BOTH of these will allow you to keep going and keep the conversation moving to get through this pandemic.

Focusing on new members who will borrow from you, and thinking about the untapped market will promote growth in your loan book

So sing your stories from the rooftops! All your members are extremely proud to be a part of the Credit Union movement. Let’s get more members into the Credit Union Club.

As your strategic partner, we’re with you every step of the way!

Credit Unions – we want to thank you

David took the opportunity to thank Credit Unions for all they’ve done for the community, and we very much echo his sentiment.

“I would like to thank you, really thank you, for the unheralded role that you’ve had in the profound transformation of this country.

I speak not only as an economist or a friend, but as a fan, who is in awe of the role of local community banks, helping local community people, who in another world, would not have access to credit.

Don’t ever underestimate the profound, deep and significant role the Credit Union movement has had in disseminating credit. John Hume himself, identified credit as a civil right.

You are absolutely crucial to the social economic and political development of this country and every small loan you’ve given makes all the difference. Imagine the plans that have come to floriation, imagine the kids, grandkids born from this. Every small loan is an act of transformation”.

To catch up on our other cuEngage events from 2020, please click the button below: