Can branding really help grow your Credit Union? Check out the results Health Services Staffs Credit Union have achieved since adopting consistent branding!

- 68% increase in online users (cuOnline & cuMobile)

- >25% loan book growth

- 48% in new member growth

- 100% increase in Facebook followers

- > 2500 Instagram followers since launch

- 160% increase in scholarship applications

.png?width=667&name=Marketing%20Brand%20(Blog%20Banner).png)

Credit Unions are the most trusted financial institution in Ireland (7 years running!) and brand loyalty is strong with existing members. The main challenge for today’s Credit Union is attracting new cohorts, but with so many marketing channels available, a strong brand is key to cut through the noise.

Marketer Pádraig Power knows the importance of branding and in his recent presentation at cuEngage, he shared his steps to creating your Credit Union brand, using some examples of the branding projects he led for Health Services Staffs Credit Union (HSSCU).

- Step 1: Define your brand

Your core brand values are the beliefs that you, as a Credit Union, stand for. They guide your brand story and shape every aspect of your business. Sit down with your board, colleagues and members and jot down what your Credit Union truly stands for. These are your brand values.

- Step 2: Create your brand promise

Once you know what you stand for you can create your brand promise. Your brand promise is a value or experience your members can expect to receive every single time they interact with you. Pádraig advises that when you make a brand promise make sure it is something that is true to your Credit Union, because if it is not, you could do real damage to your brand reputation.

The more you deliver on your promise, the stronger your brand value is in the mind of your members and employees. Below are some brands that Pádraig feels have great brand recognition.

- Step 3: Design your brand identify

To help create your brand identity, Pádraig recommends working with a design company as it is worth the investment!

Regardless of whether you use an agency or not, it is recommended to create a brand guideline document that details your brand colours, fonts, image style and logos. Once you have defined your brand guideline stick to it!

For example, HSSCU use red as their primary colour, grey as their secondary and white as an offset colour throughout everything they do. Their images all follow a similar style, and their logo is used consistently throughout their communications.

This allows them to remain recognisable when their members are scrolling through social media or browsing online.

- Step 4: Differentiate with your unique selling propositions (USPs)

Your USPs are the unique benefits of your Credit Union that enables you to stand out from your competitors. The key to any USP is that is must be true to your Credit Union and meaningful to your members.

Credit Unions have lots of USPs – community first, member focused, not for profit, most trusted brand in Ireland etc. However, if you’re struggling to create your own USP, WordStream have an excellent article on ‘How to Write a Ferociously Unique Selling Proposition’ that has some excellent examples.

- Step 5: Be aware of your market position

This is very important. Pádraig stresses that being honest and authentic as to who you are and what you offer is how you are going to be able to grow and build authentic relationships. There is no point in saying you're the most technically advanced financial institution if you’re not. (Then again if you are, shout it from the rooftops!)

Be aware of where you are as that is how you are going to be able to grow authentic relationships

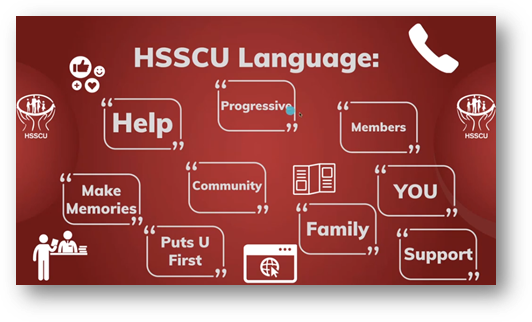

- Step 6: Decide on a brand tone of voice

What language style is organic and authentic to your members? How do their currently interact with you? Do they want the gritty technical details or something relatable to their life? Observe your genuine member conversations in branch and online and bring that into your tone of voice across your channels.

Pádraig also advises to think about what is appropriate for the different channels e.g. a savings cap letter is very different to a social media post.

- Step 7: Create a universal, multimedia brand experience

Once you have defined your brand, designed your guidelines and decided your messaging and tone of voice, you can use these to promote your Credit Union across all of your Marketing channels. Look at the example of HSSCU marketing below for their car loans. Although they are posted across multiple channels, their brand and messaging is instantly recognisable!

For more tips from the experts on how to effectively market your Credit Union, check out our other marketing series:

Promote your digital services with multi-channel marketing - Multi-channel marketing can be an excellent tool to promote your services. Here is how Klaire Klos at Scottish Police Credit Union and Conor Ralph at Member First Credit Union are using it to promote their digital services to members! [jump to blog].

How to use data to manage your marketing - Liam O’Doherty, former Marketing & Business Development at Gurranabraher Credit Union believes that data is the next frontier for the Credit Union. [jump to blog]