Liam O’Doherty, former Marketing & Business Development at Gurranabraher Credit Union believes that data is the next frontier for the Credit Union.

.png?width=680&name=Marketing%20data%20(Blog%20Banner).png)

Social media, Google analytics, Website, Email Marketing, Business Intelligence tools such Wellington IT’s cuInsight and Call Data are just some of the ways Gurranabraher Credit Union capture key marketing data. Using a data visualisation tool MS Power BI, they can integrate all these data points (including Wellington IT's cuInsight) into one dashboard for analysis.

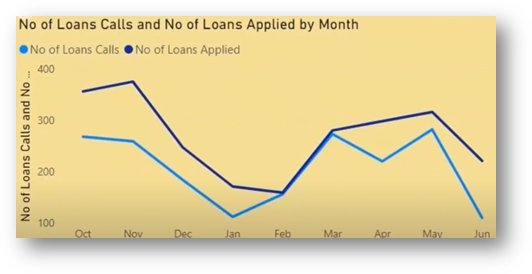

Whether you have an integrated dashboard or not, being able to interrogate and compare your data will significantly improve your decision making when planning strategy and reviewing campaign performance. For example, identifying channels loan applications were being generated from e.g. Loan Calls was a simple way to help Gurranabraher Credit Union understand how that channel was performing (see graph below).

Gurranabraher Credit Union can also use data from Google to cross reference the number of new applications with their ad spend to identify how much marketing spend it takes to get a new application, and that’s just the tip of the iceberg. Using the data available to you can make a huge impact on your marketing decisions. For example:

- Use the built-in social media analytics to see which posts your members are resonating with by measuring their likes, shares and comments.

- Use BI tools such as cuInsight to identify which types of loans are proving the most popular and create a campaign around this for email, social etc. to boost your loan book. Check out our workshop on Marketing with cuInsight to guide you.

- Use your web analytics tool to see which web pages members are visiting to see where you are getting the most conversions.

The possibilities are endless!

Below is an example of how Central Liverpool Credit Union use data analytics to gather more granular data on their members, saving them hours per week on reporting.

For more tips from the experts on how to effectively market your Credit Union, check out our other marketing series:

Branding your Credit Union: Cut through the noise and grow your loan book - Marketer Pádraig Power knows the importance of branding and in his recent presentation at cuEngage, he provided his steps to creating your Credit Union brand, using some examples of the branding projects he led for Health Services Staffs Credit Union. [jump to blog].

Promote your digital services with multi-channel marketing - Multi-channel marketing can be an excellent tool to promote your services. Here is how Klaire Klos at Scottish Police Credit Union and Conor Ralph at Member First Credit Union are using it to promote their digital services to members! [jump to blog].

.png?width=671&name=Marketing%20blog%20banner%20%20(2).png)