Multi-channel marketing can be an excellent tool to promote your services. Here is how Klaire Klos at Scottish Police Credit Union and Conor Ralph at Member First Credit Union are using it to promote their digital services to members!

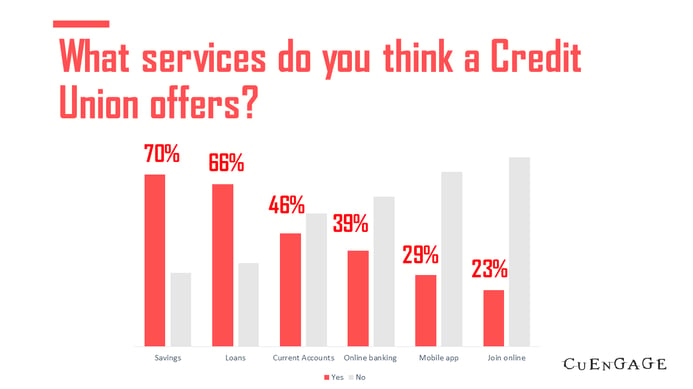

- 39% of the Irish public know that Credit Unions offer online banking

- Only 29% know that Credit Unions offer a mobile app

- Just 23% know there is an ability to join online

In Spring 2021 we commissioned a national survey to be carried out by independent market research company, Censuswide to find out the public perception of Credit Unions and what would make them switch from their current financial provider. You can catch up on the full survey results here.

The stats above really stood out to us. They suggest an image problem within Credit Unions. You can have all the technology there is to offer, but without marketing your services effectively, you will never change the perception the public have about Credit Unions.

The good news is, 58% of all participants stated that they would switch their primary financial provider to their local CU knowing they have all these services!

Klaire Klos, Business Development & Marketing Manager at Scottish Police Credit Union is no stranger to this problem. In her cuEngage session in 2021, she provided some simple tips on how her Credit Union adopted a multi-channel marketing approach to market their digital loans.

- Emailing Marketing

In March 2021, Scottish Police Credit Union (SPCU) ran an email marketing campaign to promote their online loan offering. They engaged members with simple images and GIFs and adopted a "one click" approach to apply to offer ease and convenience to their members.

SPCU ran these email campaigns to their members on a monthly basis, always keeping their message and call-to-action simple for their members and included content such as tutorials on how to use their digital services.

- Social Media

The Credit Union also ran competitions on social media and shared member stories to increase their engagement online. They created adverts and short videos on what they had to offer by way of digital loans services and encouraged members to apply for their loans online.

- Direct mail & text messages

For those members who weren’t digitally savvy, they posted letters and flyers with easy steps to join online, as well as text messages that directed them to their video tutorials.

As you can see from the chart below, the value of their loans and the number of their loans drastically increased, all from a simple piece of marketing.

Another great example of multi-channel marketing is Member First Credit Union (MFCU). Their Digital Marketing Manager, Conor Ralph adopted a multi-channel marketing approach when promoting their new mobile app, cuMobile:

Another great example of multi-channel marketing is Member First Credit Union (MFCU). Their Digital Marketing Manager, Conor Ralph adopted a multi-channel marketing approach when promoting their new mobile app, cuMobile:

- Email marketing

An email campaign announcing the product release was sent to their members which resulted in 5000 downloads alone! This was quick win for the Credit Union!

- Social Media

MFCU fully integrated the app to their social media plan including Facebook where they have 20,000+ members. They also added in some budget to increase their audience reach. Below is an example of advert they produced recently to promote the Face and Touch ID features of the app.

- In branch

Due to Covid-19 MFCU could not carry out their usual launch activity in branch, however they had information on their digital screens to promote the new app to members and tellers would talk about the app when serving members.

- Phone

Having already trialled the mobile app before launch, the MFCU Member Services team were able to convert members on the phone who were requesting services such as setting up DD’s, which they can do through the app. In addition, members in call waiting ques were informed about the app and encouraged to ask a staff member about it.

- Website

%20(4).png?width=596&name=Marketing%20Brand%20(Blog%20Banner)%20(4).png)

The website is a massive part of their app promotion and they incorporated the mobile app into their landing pages and member journey to help push them towards the app. They also updated their FAQs with the app in mind.

The tightly integrated marketing strategy was a huge part of their member uptake and resulted in over 8500 downloads in just a few short months. Next steps for MFCU is to build on this with new marketing content including video tutorials for their members and scripts for the call center staff to convert members to the mobile app. Read their full case study below.

For more tips from the experts on how to effectively market your Credit Union, check out our other marketing series:

How to use data to manage your marketing - Liam O’Doherty, former Marketing & Business Development at Gurranabraher Credit Union believes that data is the next frontier for the Credit Union. [jump to blog]

Branding your Credit Union: Cut through the noise and grow your loan book - Marketer Pádraig Power knows the importance of branding and in his recent presentation at cuEngage, he provided his steps to creating your Credit Union brand, using some examples of the branding projects he led for Health Services Staffs Credit Union. [jump to blog].

.png?width=612&name=Marketing%20blog%20banner%20%20(4).png)